The terms merger and acquisition have been adopted from the American legal standard. A merger is a process whereby companies are merged or combined without liquidation. The main reasons why companies decide to merge are, for example, to restructure the entities, to improve the economic situation of the company or to gain a larger market share.

A merger is also beneficial when filing a tax return. If you have more than one company, you have to file a separate tax return for each of them. When you merge or consolidate companies into one, you can achieve significant economies of scale and synergies.

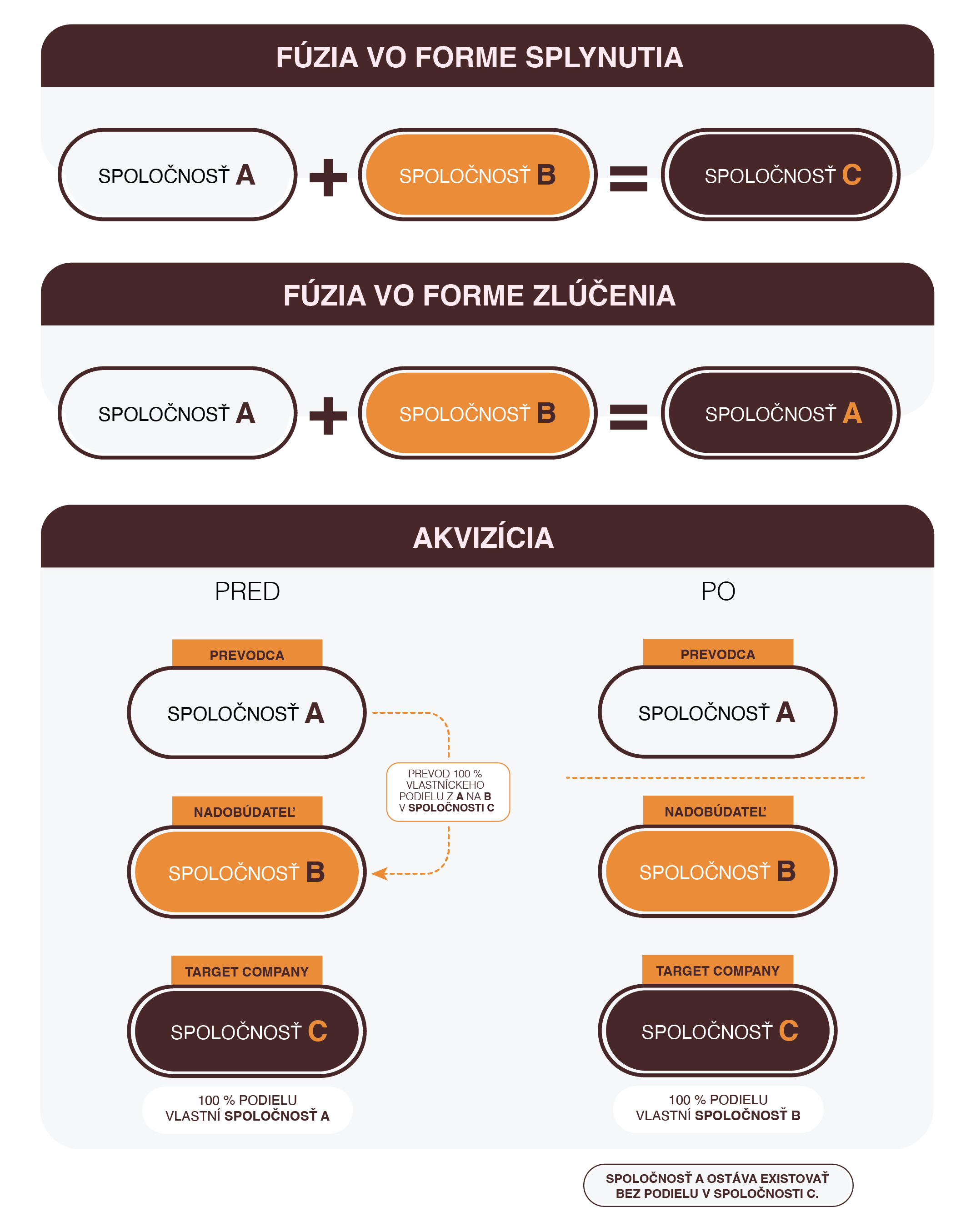

An acquisition is usually undertaken when one company or investor acquires a majority of the equity interest in another company. Acquisition may also mean the acquisition of only a part of the equity interests in another company, or the joint acquisition of equity interests in a company by multiple entities.

Acquisition generally refers to the takeover of one company by another. It means that an investor acquires an ownership interest in the target company (a share of the profits). If there are multiple investors in a company after an acquisition, it is necessary to set up relationships between them. For example, through call and put options, the right to join in the transfer of shares or pre-emptive rights, or agreements between investors to exercise voting rights.

The legal and tax shield must also be determined in the transaction of selling the company. Likewise, it is important to compare the offered price with the fair price. The latter should be calculated through an EBITDA multiple (earnings before interest and taxes plus depreciation and amortization) or through the free cash flow method (after-tax earnings are net of only non-cash items – depreciation, amortization, provisions). The seller must be prepared for the sale by separating non-core assets and conducting a pre-acquisition audit.

A merger in the form of a consolidation refers to the uniting of two or more companies into one. After merging, the companies cease to exist as separate business entities. Their assets are transferred to the newly created company, which becomes the legal successor of the dissolved companies. The new company may, after the merging process, operate under a new business name.

A merger in the form of an amalgamation means that one company absorbs the other company, which ceases to exist. At the same time, the company that is not dissolved becomes the legal successor of the dissolved company. This form is preferred if one of the two companies has public licenses that need to be maintained. That is because they do not automatically transfer to the new entity when the merger takes place, but are subject to new applications and procedures.

Grafické znázornenie

Fúzia vo forme splynutia

Spoločnosť A + Spoločnosť B = Spoločnosť C

Fúzia vo forme zlúčenia

Spoločnosť A + Spoločnosť B = Spoločnosť A

Akvizícia

Pozn. Spoločnosť A ostáva existovať bez podielu v spoločnosti C.

Mergers are among the more challenging procedures with clearly defined rules and specifications.

The merger and acquisition process only applies to companies that:

• are not in liquidation,

• are not bankrupt,

• are not in restructuring proceedings,

• are not in dissolution proceedings, and cannot be dissolved by or pursu

The typical methods of acquiring control of a company (acquisition) are the transfer of a business share (share deal) and the transfer of the business itself or its components (asset deal), which usually involve the following procedure:

There are several benefits of merging companies, including:

f you decide to increase the efficiency of your business with a merger and acquisition, you must take into account the complexity of the process. For most companies, this is not a routine matter, which is why you should contact an experienced law firm. Any mistake can prolong the whole process or it may not even succeed.

Failure to comply with the rules can result in the refusal to register the merger in the commercial register. In addition, every avoidable mistake causes an increase in costs that will make the whole process considerably more expensive.

Lorem Ipsum Text Lorem Ipsum Text Lorem Ipsum Text Lorem Ipsum Text

When companies merge, all the assets of the merging company are transferred to the acquiring company. The latter becomes the legal successor. The legal effects of the merger are effective from the date of registration in the commercial register, thus the dissolved company loses its status of an independent business entity.

Thus, you file your VAT return until the legal entity is officially merged and entered in the commercial register. Only after the company has been dissolved, entered in the commercial register and its business assets transferred to the successor does the acquiring company become a single taxable entity. For example, Company A was a quarterly VAT payer and the successor Company B was a monthly VAT payer. Company B files a single tax return for its monthly period and a tax return for the quarterly period for the defunct Company A under its VAT number at its competent tax office.

The last change regarding merging and amalgamation of companies was made by the amendment of Act No. 264/2017 Coll., which amended Act No. 513/1991 Coll., the Commercial Code. The amendment is intended to prevent dishonest mergers and acquisitions of commercial companies. Thus, legislation is generally changed if, for example, it is ineffective or outdated.